UNCORKED POTENTIAL

Suzanne Denevan-Brown continues to guide us through the ins and outs of investing in fine wine, gathering the best advice from experts in the field

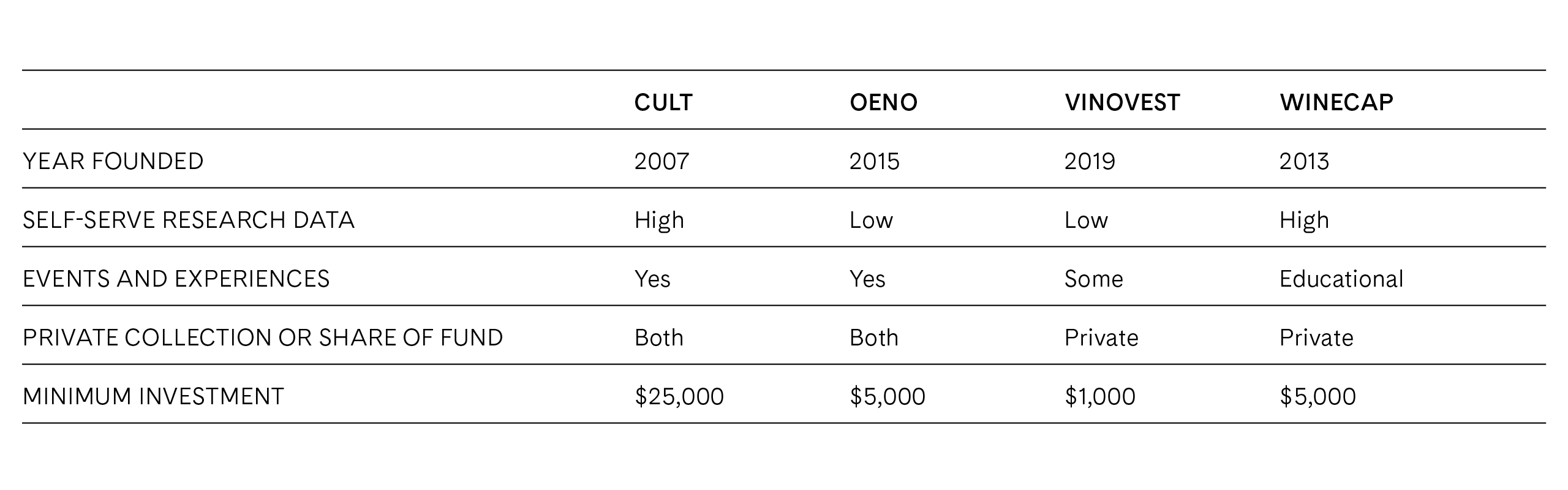

Investing in wine today is more accessible than ever, through services that acquire, manage, store and insure private collections. They offer the opportunity for investors to own a diversified selection of fine wines without the need for extensive knowledge or storage space. I spoke with Carrie Tuck, CMO of Cult Wines; Michael Doerr, president of Oeno Future; Anthony Zhang, co-founder of Vinovest; and Alexander Westgarth, CEO of WineCap, to better understand the choices available to today’s fine wine investor.

WHY FINE WINE

As an asset class, fine wine bears consideration as part of a diversified investment portfolio. All of the executives spoken with cited its low correlation with traditional asset classes, and its favorable historical returns performance when compared to stock equities. And there’s another unique, tangible aspect to fine wine – it gets consumed. As Carrie Tuck from Cult Wines explains, “the global universe of investment-grade wine is fixed in supply and is exacerbated over time as the available wine is consumed and diminished… which mitigates risk and reduces levels of volatility.”

CLIENT-CENTRIC

In each of the services, the individual client is the driver of the composition of the collection. An advisor will aid a client in defining their investment profile, paying particular attention to their risk profile and projected length of investment. In all cases, the services combine human experts with proprietary data to build client collections.

Alexander Westgarth of WineCap describes the firm’s approach this way: “Most clients will continue to invest with the help of advisors, always with a keen eye on maintaining a sound portfolio structure. We leverage data in our processes but ensure that all our clients receive assistance and guidance from a real person.”

Vinovest leverages an algorithm that is ingesting data and learning as it goes. “Clients can build portfolios of world-class wine with the help of our dedicated portfolio advisors and proprietary machine-learning algorithm that searches for personalized buying opportunities,” says co-founder Anthony Zhang.

“The global universe of investment-grade wine is fixed in supply and is exacerbated over time as the available wine is consumed and diminished, which mitigates risk and reduces levels of volatility”

Cult Wines CMO Carrie Tuck

INVESTMENT MODEL

Here is where you’ll find differences that will dictate which service is best for your investment objectives. Both WineCap and Vinovest end their service offerings at individually held private collections. The client owns the individual cases of wines. In this scenario, maximizing returns is generally dependent on holding your wine for at least five years. Time allows for the rarity of your holdings to increase as supply diminishes.

Westgarth puts it this way: “We understand that in an asset class like fine wine, frequent active trading might not be in our clients’ best interest. We are after wines that have a proven history of performance and liquidity.”

As a contrast, both Cult Wines and Oeno introduced more traditional “fund” options this year. Funds provide an option to invest in wine more as a security rather than as an individual collection. Michael Doerr of Oeno believes this is the result of client demand. “We wanted a route for clients who craved the security of going through a regulated model rather than an unregulated investment like private portfolios.” Several of the company’s private portfolio clients are themselves hedge fund managers, who asked for a fund. “So they could open this opportunity up to their network,” he says.

ACTIVE OR PASSIVE?

How actively or passively do you want to treat your investment in fine wine? Do you like to dig in and do your own research? Are you interested in arranging your own itinerary for winery visits or are you more likely to join an organized event?

If you want to dig in on data, the wine tracker at WineCap is a great place to get lost scrolling. “We have created a free and available-to-all tool, Wine Track, which shows the performance, average price and critic score of over 3,000 wine brands,” says Westgarth. Education and experiences for WineCap are less hedonistic and more intellectual – Westgarth says it’s a matter of focus – and delivering the best possible wine investment service.

On the other hand, with Vinovest, the investor’s wine knowledge is immaterial – in fact, one of its selling points is democratizing access to rare wines through its algorithm. Knowing wine regions or producers is wholly unnecessary. You can, however, grow your interest in wine with the Vinovest Community. “The Vinovest Community offers a space for people to connect with others, share helpful tips, ask questions, support one another, and build better portfolios through wine and whiskey investing,” says Zhang. “Currently, the community is home to more than 2,500 members from 49 countries.”

Cult Wines’ approach is one that “mirrors a traditional investment approach; the portfolio of wines is actively managed and rebalanced based on the return objective,” explains Tuck. “The process and framework is reviewed and validated by our investment committee.” With the largest minimum investment requirement of $45,000 for a private collection and $25,000 for new fund options, Cult Wines offers the same sophisticated tools and packaging you expect to find with large financial services companies.

As with other financial services firms, Oeno also prides itself on their level of service. Its advisors are incentivized based on client satisfaction. Its approach to building the portfolio speaks of the same fundamentals as the others. “We are trying to show good steady growth for the long term, so we tend to stick to wines that have proven track records and global demand,” says Doerr.

One interesting aspect to Oeno is its in-house ability to sell client wine upon liquidation. Oeno Trade allows investors to sell directly to the trade. Oeno House may buy client wine to serve at their wine bar in London. Unsurprisingly, a firm with a built-in “House” to its business is oriented to experiences. Plans shared by Doerr include “tastings all over the world” and “hosting a gala ball once a year at a high-end estate.”

There’s never been an easier time to invest in fine wine for portfolio diversification and connection with like-minded individuals. Whatever route you choose to take, approach wine investing with caution and seek advice from professionals.

We recommend

LIQUID ASSETS

Chosen with care like art, fine wine can be a great investment. But what are the best ways to get started? Suzanne Denevan-Brown kick-starts our new series

MAKING HISTORY

With high praise for Argiano’s award-winning Brunello di Montalcino, winemaker and CEO Bernardino Sani shares his recipe for success, and his story, with Brian Freedman

DOORS OF PERCEPTION

John Irwin delves into the art of wine talk and explores how our individual cultural backgrounds influence how we see the world – and taste it

SUPER LEAGUE

Is it time to drop the name Super Tuscan and focus on quality? Cynthia Chaplin explores the new landscape of Italy’s most famous and prolific wine region